If you are curious about crypto, this article discusses two major concepts: crypto wallets and exchanges.

Find explanations, comparisons, and more.

Crypto Wallets

A crypto wallet is like a digital bank account for your cryptocurrencies.

It stores your private keys, which are like secret codes that allow you to access and manage your crypto funds.

There are two main types of crypto wallets, custodial and non-custodial:

- Custodial wallets are managed by third-party platforms, like exchanges. They’re easy to use but come with the risk that the platform could be hacked or shut down.

- Non-custodial wallets give you full control over your private keys. They’re safer but require more technical knowledge to set up and use.

Wallets can also be categorized as hot (connected to the internet) or cold (offline), each with its own benefits and drawbacks.

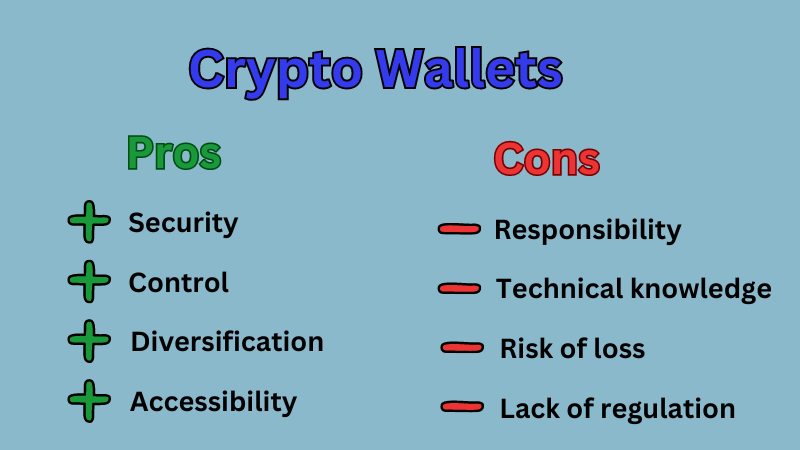

Pros

Security. Crypto wallets provide a secure way to store your digital assets, protecting them from hacks and unauthorized access.

Control. With a personal crypto wallet, you have full control over your private keys, allowing you to manage your funds independently without relying on third parties.

Diversification. Crypto wallets enable you to hold various cryptocurrencies in one place, allowing you to diversify your investment portfolio easily.

Accessibility. Many crypto wallets offer user-friendly interfaces and mobile apps, making it convenient to access your funds anytime, anywhere.

Cons

Responsibility. With great control comes great responsibility. Managing your own crypto wallet means you’re solely responsible for keeping your private keys safe. Losing your keys could result in permanent loss of access to your funds.

Technical Knowledge. Setting up and managing a crypto wallet requires some technical know-how, which can be intimidating for beginners.

Risk of Loss. If you lose, damage, or have your device containing the wallet stolen, you may permanently lose access to your funds unless you have a backup.

Lack of Regulation. Since crypto wallets are decentralized and largely unregulated, there may be limited recourse in case of disputes or fraudulent activities.

Crypto Exchanges

A crypto exchange is like a digital marketplace where you can buy, sell, and trade cryptocurrencies.

Just like a stock exchange, you can trade different cryptocurrencies based on their market prices.

There are two main types of crypto exchanges, centralized and decentralized:

- Centralized exchanges (CEXs) are operated by companies and hold your funds on your behalf. They’re easy to use but less secure.

- Decentralized exchanges (DEXs) operate without a central authority and allow you to trade directly with other users. They’re more secure but can be complex to use.

When choosing an exchange, consider factors like security, fees, supported currencies, user interface, and customer support.

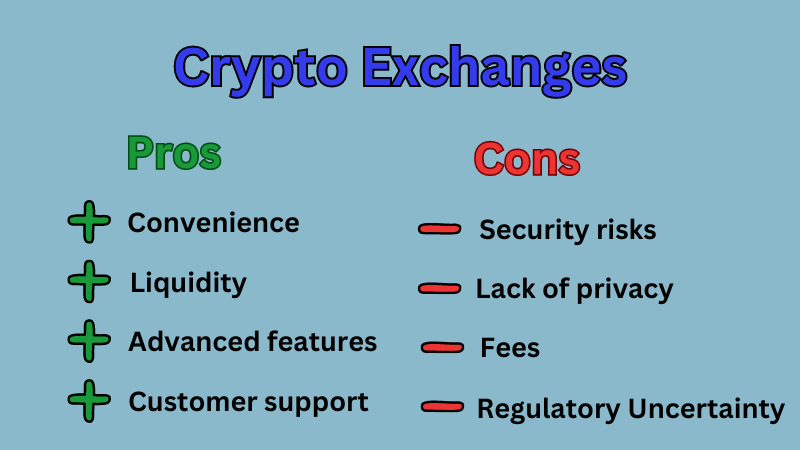

Pros

Convenience. Crypto exchanges offer a convenient platform for buying, selling, and trading cryptocurrencies, providing easy access to a wide range of digital assets.

Liquidity. Exchanges facilitate high trading volumes, ensuring liquidity for various cryptocurrencies and enabling quick transactions.

Advanced Features. Many exchanges offer advanced trading features like margin trading, futures contracts, and trading analytics tools, catering to experienced traders.

Customer Support. Reputable exchanges often provide responsive customer support to assist users with inquiries, technical issues, and account security concerns.

Cons

Security Risks. Centralized exchanges are susceptible to hacking attacks and security breaches, leading to potential loss of funds for users.

Lack of Privacy. Some exchanges require users to undergo identity verification procedures, compromising user privacy and anonymity.

Fees. Exchanges charge fees for their services, including trading fees, withdrawal fees, and deposit fees, which can eat into your profits.

Regulatory Uncertainty. Cryptocurrency exchanges operate in a regulatory gray area in many jurisdictions, leading to uncertainty regarding legal compliance and potential regulatory changes.

Summary – Crypto Wallets and Exchanges

In summary, crypto wallets are like digital safes for storing your cryptocurrencies, while crypto exchanges are like online marketplaces for buying, selling, and trading them.

Both play important roles in the world of cryptocurrencies, and it’s essential to choose ones that prioritize security and meet your needs.

FAQ about Crypto Wallets and Exchanges

What is a cryptocurrency wallet❓

A cryptocurrency wallet is a digital tool that allows users to securely store, send, and receive cryptocurrencies.

How does a cryptocurrency wallet work❓

Wallets store private keys that enable access to cryptocurrency holdings on the blockchain. Users can send or receive cryptocurrencies by using their wallet’s unique addresses.

What types of cryptocurrency wallets are there❓

There are two main types: hot wallets (connected to the internet) and cold wallets (offline for enhanced security). Hot wallets include software wallets (mobile, desktop, online) and exchange wallets. Cold wallets include hardware wallets and paper wallets.

What is a cryptocurrency exchange❓

A cryptocurrency exchange is a digital platform where users can buy, sell, and trade cryptocurrencies.

How do cryptocurrency exchanges work❓

Exchanges match buyers and sellers and facilitate transactions by providing trading pairs, order books, and trading interfaces. They also offer services like storing cryptocurrencies in exchange wallets.

Are cryptocurrency exchanges safe❓

Exchange safety varies. Trusted exchanges implement security measures such as two-factor authentication, encryption, and cold storage for funds. Researching an exchange’s reputation and security practices is essential.

How do I choose the right cryptocurrency exchange❓

Consider factors such as security features, supported cryptocurrencies, trading fees, user interface, customer support, and regulatory compliance.

What is the difference between centralized and decentralized exchanges❓

Centralized exchanges (CEXs) are operated by a central authority and facilitate trades using an order book. Decentralized exchanges (DEXs) operate without a central authority and allow peer-to-peer trading directly from users’ wallets.

Can I store cryptocurrencies on exchanges❓

While exchanges offer wallets for storing cryptocurrencies, it’s generally recommended to transfer funds to a personal wallet for greater security and control.

How can I keep my crypto assets safe❓

Practice security measures such as using hardware wallets, enabling two-factor authentication, keeping private keys secure, avoiding suspicious links or emails, and staying informed about security best practices.